Treasury Bills and Bank Negara Bills Popular. Malaysian Islamic Treasury Bills MITB MITB are short-term securities issued by the Government of Malaysia based on Islamic principles.

Bangladesh Treasury Bills Rate 182 Days Economic Indicators Ceic

Blow are the 91-day Treasury Bill Average Rates for the year 1994 to date.

. Malaysia - Risk premium on lending prime rate minus treasury bill rate - actual values historical data forecasts. Table 24 Data as at Jan 2019. Knoema an Eldridge business is the premier data platform and the most comprehensive source of global decision-making data in the world.

MITB are usually issued on a weekly basis with original maturities of 1-year. Download previous issues PDF. Exchange Rates Jun 02 2022.

Offers attractive interest rates. High liquidity in secondary market. 10-Year Malaysian Government Securities Tender Result for 23 May 2022.

Our revolutionary technology changes the way individuals and organizations discover visualize model and present their data and the worlds data to facilitate better decisions and better outcomes. Bills are sold at discount through competitive auction facilitated by Bank Negara Malaysia with original maturities of 3-month 6-month and 1-year. Discounted rate based on.

K1300000 or K125900000 NOT K2452000 Non-competitive. Treasury Bills and Bank Negara Bills Popular. FDH licensed to sell bills in bits to individual and corporate clients from a minimum of K10000000.

Bills are sold at discount through competitive auction facilitated by Bank Negara Malaysia with original maturities of 3-month 6-month and 1-year. Malaysian Treasury Bills MTB MTB are short-term securities issued by the Government of Malaysia to raise short-term funds for Governments working capital. 21 rows Rates.

Payable at face value on maturity. No credit risk as issued by the government. Bills issued in tenors of 91 days 182 days and 273 days.

The redemption will be made at par. Primary auction done every Friday and settlement effected every Thursday. Central Bank Rate is 200 last modification in May 2022.

The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity. Investors are encouraged to verify processing fees with their commercial banks before investing in Treasury Bills. The Malaysian government also issued another Malaysian Islamic Treasury Bill worth RM25 billion US57423 million.

Malaysia 10Y Bond Yield was 418 percent on Tuesday May 31 according to over-the-counter interbank yield quotes for this government bond maturity. Traded in multiples of RM10000. Condensed interest rates tables provide recent historical interest rates in each category.

Treasury bills with a face value of Rs. Stay on top of current and historical data relating to Malaysia 3-Month Bond Yield. Free of default risk.

Government Securities data is updated yearly averaging 3485 pa from Dec 1976 to 2016 with 41 observations. This records a decrease from the previous number of 3109 pa for 2015. Tenure less than one year.

As an additional resource we also provide summaries and links to recent interest rate related news. Government Securities data was reported at 2758 pa in 2016. Table 24 Data as at Sept 2018.

The Malaysia credit rating is A- according to Standard Poors agency. The 91 Days Treasury Bills are debt obligations issued by RBM on behalf of the Government of Malawi for the 3 months either a discount or face value at a competitive auction on a weekly basis. Issued by BNM on behalf of Government and traded on a discounted basis.

According to tender results the offering received RM331 billion US76332 million in bids. The standard trading amount is RM5 million and it is actively traded in the secondary market. Normal auction day is Thursday and.

Normal Convexity in Long-Term vs Short-Term Maturities. 10 Years vs 2 Years bond spread is 94 bp. Current 5-Years Credit Default Swap quotation is 5719 and implied probability.

Short term securities issued by Malawi government through the Reserve Bank Of Malawi. Malaysian Treasury Bills MTB MTB are short-term securities issued by the Government of Malaysia to raise short-term funds for Governments working capital. Historically the Malaysia Government Bond 10Y reached an all time high of 535 in April of 2004.

Malaysia Treasury Bills 211 235 251 Malaysia Islamic Treasury Bills 210 231. The Malaysian government has issued a RM1 billion US23061 million one-year Islamic treasury bill on the 13th May 2020. Treasury Bills and Bank Negara Bills.

Individuals can purchase treasury bills at a discount to the face value of the security which can then be redeemed at a nominal value. Short and long term investment on outright sale basis. Malaysia Treasury Bill Rate.

182-Day Malaysian Treasury Bills Tender Result for 18 May 2022. Risk premium on lending lending rate minus treasury bill rate in Malaysia was reported at 17733 in 2016 according to the World Bank collection of development indicators compiled from officially recognized sources. 30-Year Government Investment Issues Tender Result for 12 May 2022.

273-Day Malaysian Islamic Treasury Bills Tender Result for 25 May 2022. The minimum amount to be recorded on the bid form Maturity Value before Tax is K1000000 in excess of which all quotations should be in multiples of K100000. Alternative means of investment other than traditional deposit products.

Treasury Bills over 31 days for Malawi from International Monetary Fund IMF for the International Financial Statistics IFS release. 91 for example. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1 3 6 and 12 months.

This page provides forecast and historical data charts statistics news and updates for Malawi Treasury Bills over 31 days. The Malaysia 10Y Government Bond has a 4251 yield.

How To Visually Explain The Rise In Treasury Yields Nasdaq

Descriptive Statistics Of The Bond Yield Spreads Download Table

Malaysia Treasury Bill Rate Government Securities Economic Indicators Ceic

How To Visually Explain The Rise In Treasury Yields Nasdaq

How To Visually Explain The Rise In Treasury Yields Nasdaq

Malaysia Real Interest Rate Economic Indicators Ceic

Descriptive Statistics Of The Bond Yield Spreads Download Table

Treasury Bonds Prospectus Bank Of Tanzania

Malaysia S Bond Market Landscape Bondsupermart

Lure Of Malaysia S High Yield Bonds The Star

How To Visually Explain The Rise In Treasury Yields Nasdaq

How To Calculate The Percentage Return Of A Treasury Bill Nasdaq

United States 1 Year Treasury Bill Secondary Market Rate 2022 Data 2023 Forecast 1959 Historical

Malaysia Treasury Bill And Government Securities Rates Annual Ceic

Line Graph Showing Trend Of Treasury Bill Rate Tbr From 1980 2013 Download Scientific Diagram

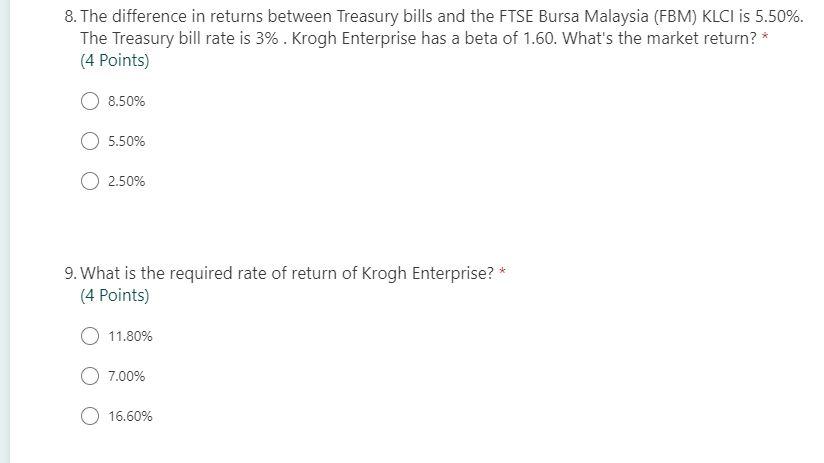

Solved 8 The Difference In Returns Between Treasury Bills Chegg Com